Bernhard Inspiring the Next Generation of Energy Industry Leaders

Bernhard has been growing strong for 104 years now. We believe one of the biggest factors in our longevity is an idea that’s been with us since the beginning: a company-wide commitment to recruiting, training and nurturing the future work force.

By recruiting, supporting and listening to Bernhard’s next generation, we give employees the support and confidence they need to find their professional passions, make hard decisions and propose bold ideas. In doing so, we prepare our company to evolve and capitalize on new innovations while simultaneously creating the leaders who will propel Bernhard into its next great century.

TRAINING

One important way Bernhard supports and shapes the next generation of leadership is through comprehensive training, with a commitment to safety and minimizing risk. Getting employees started on the right foot is a task that’s too important to outsource. Bernhard currently runs the largest private electrical apprenticeship program in Louisiana, with more than 100 apprentices attending classes every Friday either virtually or in person.

Taught by Associated Builders and Contractors (ABC)-certified instructors who are also top Bernhard foremen with years of on-the-job experience, the four-year program gives electrical apprentices a solid foundation of knowledge about complex electrical systems. Lessons are often designed around the findings of real-world incident investigations, to help workers move beyond theory and understand how staying safe is everyone’s responsibility.

“This field is always changing,” said Josh Boggan, electrical superintendent and an instructor in the Bernhard apprentice program. “By running our own training programs, we’re making sure apprentices get a solid footing in modern electrical and what the job entails, but we’re also constantly reinforcing Bernhard’s safety-first, ‘think before you act’ culture. Whether they stay with Bernhard their entire careers or not, this training might literally save a life someday.”

Participants graduate with an electrical certification from the National Center for Construction Education and Research (NCCER). That’s followed by Bernhard’s fifth-year Journeyman Prep class. Taught by one of Bernhard’s master electricians, the class prepares graduates for the City of New Orleans Journeyman license exam while further reinforcing the company-wide imperative of bringing a safety-first mindset to every job.

MENTORING AND PROFESSIONAL DEVELOPMENT

Bernhard is always looking for ways to support, shape and retain future leaders who will continue our company’s success. That’s why giving young employees a great start through professional development, mentoring and contact-building isn’t just a goal at Bernhard, it’s a priority.

One example of that commitment is Bernhard’s Young Professionals program. Launched in 2022, the four-year program is free to join, and open to any Bernhard Engineering employee who is under 30 or less than four years post-graduation from college. Through networking opportunities, mentorship and group team building and training events, Bernhard Young Professionals seeks to help every young engineer develop their strengths and talents, while giving them the tools they need to excel.

“A lot of companies talk about providing professional development, but that usually amounts to a retreat every few years,” said Katie Thomas, learning and development specialist at Bernhard. “Bernhard’s Young Professionals is a lot more in depth. We really take the time to help build the connections that can make a difference in a career.”

In addition to exclusives like pop-up networking events, Bernhard Young Professionals provides participants with twice-yearly topical education sessions hosted at Bernhard’s offices in Little Rock, as well as professional enrichment opportunities with senior members of the Bernhard engineering team. To help young workers level up their knowledge base, participation in the program also includes free access to Bernhard’s extensive library of online training materials, including courses on Jobsite Safety, AutoCAD, Conflict Resolution and more.

INNOVATIVE RECRUITING EFFORTS

AEC professions are locked in a historic, post-COVID hiring shortage that could see construction-based industries with hundreds of thousands of unfilled positions in coming years. To avoid perpetual shortages, we need strategies to help convince more young people, including many more women and minorities, to choose careers in AEC.

Bernhard is leading the way with innovative ideas to bolster interest in the AEC industry such as the 360 Promise partnership with Tulane University. 360 Promise was announced in November 2022 in the wake of Project RISE, a 30-year Energy-as-a-Service (EaaS) agreement that will help New Orleans’ Tulane University reach a goal of carbon neutrality by 2050. 360 Promise is a partnership built on a bold pledge: that Bernhard will recruit and hire 360 graduates of Tulane University over the next 30 years.

360 Promise is primarily focused on hiring graduates of the Tulane Energy Institute, a division of Tulane’s A.B. Freeman School of Business that provides educational opportunities for students looking to enter the fast-growing energy industry. That said, the hiring commitments forged by 360 Promise extend to departments throughout the university, including Tulane Law School and the School of Science and Engineering.

“Talent is a critical ingredient to success,” said Rob Guthrie, Bernhard’s Chief Development Officer. “That’s true of our industry in general, and it’s certainly true at Bernhard. By making the 360 Promise with Tulane, Bernhard is strengthening its role to shape and develop future industry leaders. It’s a bold and exciting step.”

As part of 360 Promise, Bernhard engineers and specialists will assist the Tulane Energy Institute in developing courses and a curriculum that fully prepare graduates for careers in the burgeoning energy services industry. Students in the program will learn about energy not only in the classroom, but also from real-world, past, present and future Bernhard projects. As they do, they’ll be guided and mentored by many of the seasoned professionals responsible for completing those projects on time and under budget.

For the future, the only sure thing is that things change. Companies that don’t want to get left behind have to change, too. That’s why Bernhard is committed to focusing not only on where we’ve been and where we are, but where we need to go to prepare for another hundred years of innovation. By fully embracing young workers and giving them the support, tools and opportunities they need to become the next generation of Bernhard leaders, we honor our past and set the stage for an even brighter future.

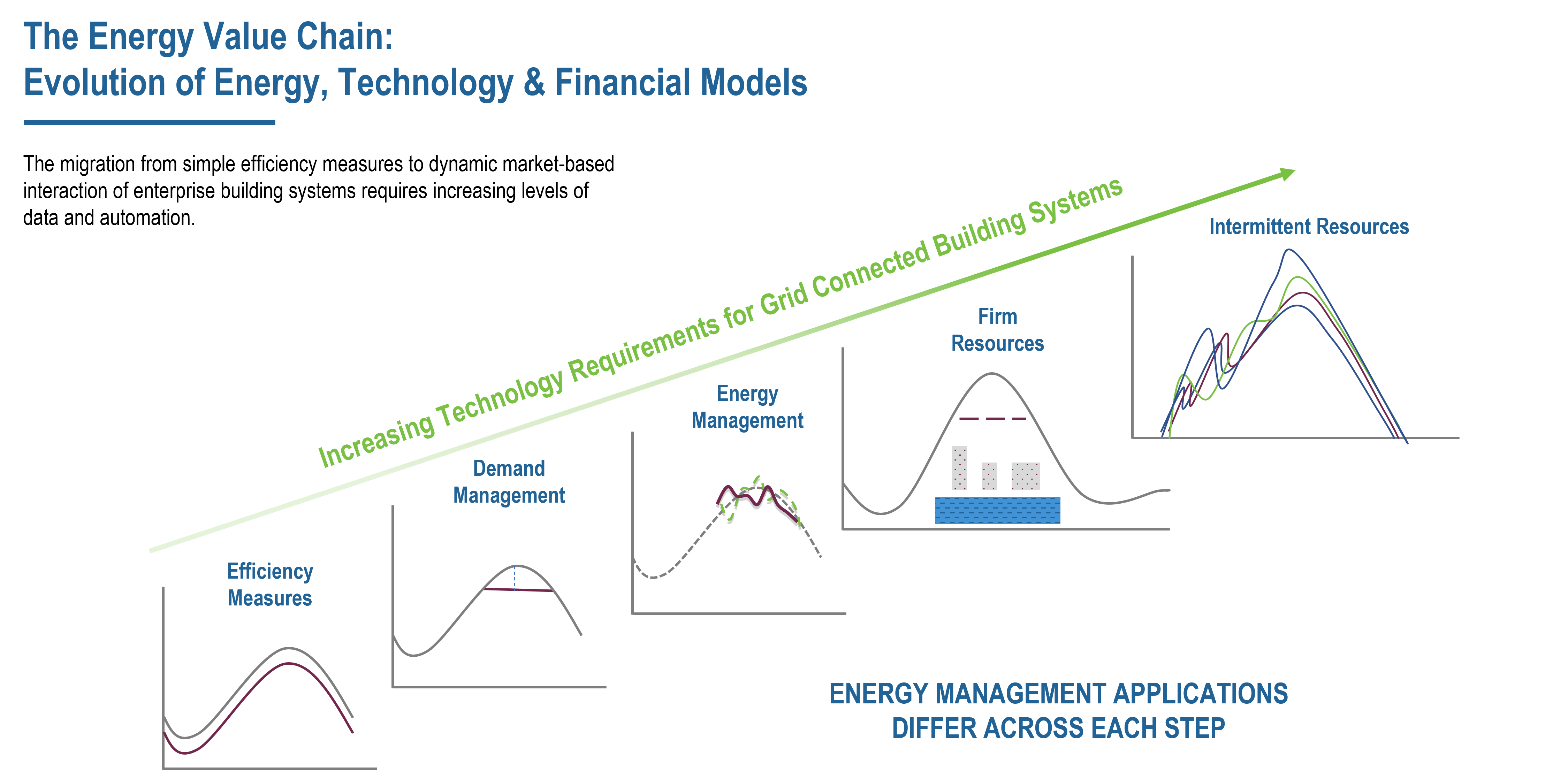

In every market, region and zone, the grid operators have to find a way to deliver steady power in real time. However, increased demand can create hot spots and additional supply resources are typically called upon with peaking plants often being the costliest forms of energy. This drives the wholesale prices of electricity up that has to be paid for by the supplier. In order for the suppliers to cover their costs and as an insurance hedge, power purchasing agreements include rates, tariffs, and demand charges that make up the difference more often than not. The customer sees these for every month on their bill.

In every market, region and zone, the grid operators have to find a way to deliver steady power in real time. However, increased demand can create hot spots and additional supply resources are typically called upon with peaking plants often being the costliest forms of energy. This drives the wholesale prices of electricity up that has to be paid for by the supplier. In order for the suppliers to cover their costs and as an insurance hedge, power purchasing agreements include rates, tariffs, and demand charges that make up the difference more often than not. The customer sees these for every month on their bill.

Leighton J. Wolffe, Vice President Demand Management for Bernhard, has more than 25 years of experience in the facilities and energy industries. His interest in technologies led to leadership positions with energy companies, manufacturers and systems integration firms designing and developing innovative hardware and software applications.

Leighton J. Wolffe, Vice President Demand Management for Bernhard, has more than 25 years of experience in the facilities and energy industries. His interest in technologies led to leadership positions with energy companies, manufacturers and systems integration firms designing and developing innovative hardware and software applications.